8 reasons why you should NOT use Kolo

Let's explore the different reasons why you shouldn’t make use of your Kolo account or encourage your family and friends to do so.

Let’s protest against financial indiscipline

It’s hard to believe it’s already been five months since we launched Kolo. But we’re grateful you’re alive to read our email. Your continued support has been our driving force, and we’re thrilled to share some exciting updates and important financial insights with you. What’s popping in the finance space? 📰 💰 Interest Rate Hike […]

Take control of your finances this July with Kolo

To make the most out of Kolo Finance, here are some key steps to help you maximize financial management with Kolo.

Answering your most asked questions

As requested, here are answers to some of the most frequently asked questions about your go to financial management app, Kolo.

Debt management strategies

Debt management can seem challenging, but with the right strategies in place, you can avoid losing control of your finances.

Managing your net worth across bank accounts

Handling numerous bank accounts can be a hassle so here are some tips to help you with proper management of all of your accounts:

Struggling to get the capital you need to run your loan business?

We are happy to announce the Onlending initiative, which is geared towards providing capital to lenders at affordable rates to boost their operations and business. With this initiative, you can start or expand your lending business capacity without worrying about where and how to raise capital.

Half of the year is gone but the other half is going to be awesome

We’ve officially blown through 50% of 2024, and we want to extend our gratitude for your continuous support and trust in us. Over the past six months, we've rolled out important features and enhancements to help you manage your loan business better.

Your admin console is now an Android app and on the Google Play Store

The Lendsqr admin console now has an Android version that is available for download on the Google Play Store. You can now access all of Lendsqr’s features directly from your mobile device and manage your lending operations on the go.

You can now assign account managers to your customers

We’ve made customer management more streamlined for you and your team. We’ve added an ‘Account Manager’ role to the admin console. Now, you can invite a team member, assign them as an account manager, and link them to a customer. T

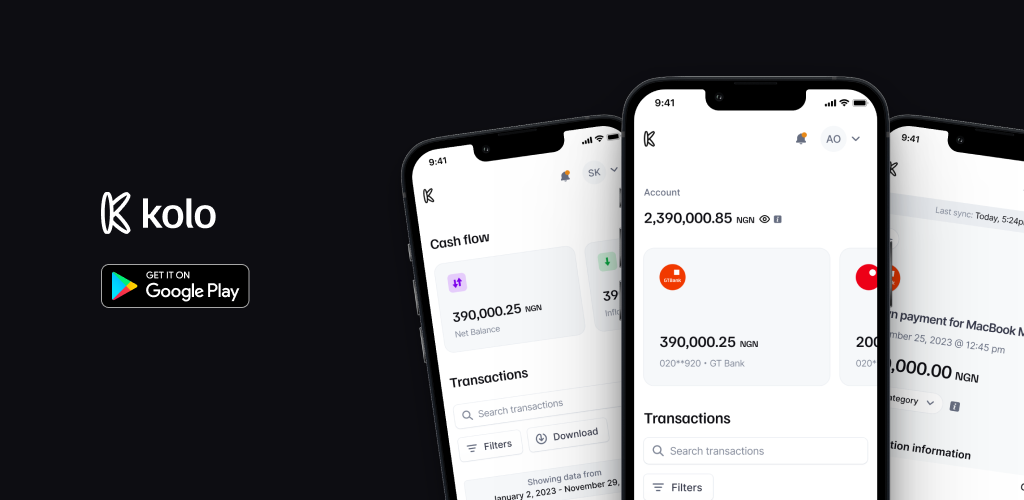

Kolo, your key to financial management

Fresh out of Lendsqr Labs, we're excited to present Kolo—an all-in-one for managing your bank balances and transactions.

You can now recover your Lendsqr account

We have introduced a seamless process for account recovery, even if you've lost access to your two-factor authentication (2FA) devices. Now, when activating 2FA, you'll generate recovery codes to ensure access in case of emergencies.